Bret Busacker

If you believe your company was subject to the Affordable Care Act (ACA) coverage requirements in 2015 (generally, all employers with 50 full-time or full-time equivalent employees), please take note that the Internal Revenue Service (IRS) is beginning to send out notices of ACA penalties due from employers who failed to satisfy ACA health coverage requirements. Specifically, the IRS is mailing Employer Shared Responsibility Payment (ESRP) notices to employers that it believes failed to comply with the ACA coverage requirements in 2015. Some employers receiving these notices may have actually complied with the ACA requirements in 2015, but the IRS received inaccurate or incomplete information and consequently has incorrectly identified the employer as failing to satisfy the ACA coverage requirements.

Limited Time To Respond To IRS Notice

If an employer receives an ESRP notice, it must dispute the IRS penalty within 30 days of the date of the notice. We have seen employers receiving very large fines for periods in which the employer actually complied with the ACA coverage requirements.

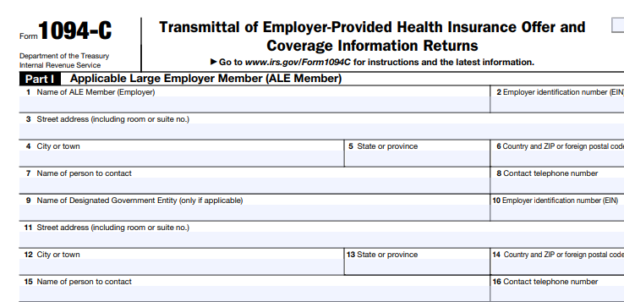

Employers who were subject to the ACA coverage requirements in 2015 should review their 2015 ACA filings (on Form 1094-C) to: (1) determine who at the company will receive the ESRP notice from the IRS, if one should arrive; and (2) make sure the contact address is correct (See Part 1; Lines 1 thru 8 of Form 1094-C). If any of the contact information on the Form 1094-C is inaccurate or if the contact person is no longer employed by the company, the employer should consider updating its contact information with the IRS. Employers with questions about responding to an ESRP notice should contact their legal counsel promptly.