Steven Eheart

On January 12, 2024, the federal Tenth Circuit Court of Appeals asked the Colorado Supreme Court to clarify whether, under Colorado law, holiday incentive pay must be included when calculating an employee’s regular rate of pay. On September 9, 2024, the Colorado Supreme Court responded: yes, it must be included.

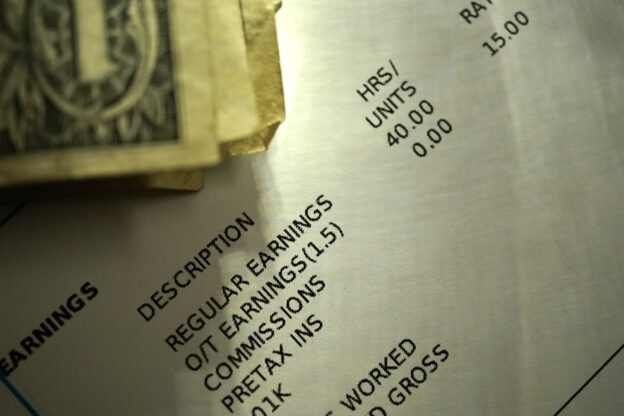

The Regular Rate of Pay

Employees who work more than forty hours per week must receive overtime pay at a rate that is 1.5 times their regular rate of pay. Some states also have daily overtime requirements; for example, in Colorado, employees who work more than 12 hours per workday or 12 consecutive hours must also receive overtime pay at 1.5 times their regular rate of pay.

Importantly, the regular rate of pay is not the same as the base hourly rate. The regular rate of pay is a calculation that incorporates non-overtime compensation received for work performed during a workweek. Read more