By Rebecca Hudson and Arthur Hundhausen

When an employee dies, deferred compensation may be due and payable to the employee’s beneficiary or estate. Employers are often tripped up by the corresponding tax reporting and withholding requirements and whether income tax and FICA tax withholdings are due from such payments. This article briefly addresses these tricky questions.

No Income Taxes Should Be Withheld

Under many employer-sponsored deferred compensation arrangements, employees earn compensation in one year that will not be paid until a future date. This may include traditional deferred compensation plans, short-term and long-term incentive arrangements, and stock awards, to name a few. When an employee/plan participant dies, the terms of the plan or arrangement typically dictate when and how the future payments are to be made to the employee’s beneficiary or estate. Employers should follow the terms of the plan and make payments and plan distributions to beneficiaries at the required times.

The proper income tax treatment of compensation that is earned preceding death, but is unpaid at the time of death, and is ultimately paid to a beneficiary or the estate of the deceased employee is outlined in IRS Revenue Rulings 71-456 and 86-109. These rulings provide that for income tax withholding purposes, these amounts do not constitute “wages.” Consequently, employers should not withhold income taxes on the amounts paid to a beneficiary or estate following an employee’s death.

FICA Taxes Still Withheld and Due If Compensation Paid In Year of Death

In an odd, and less-than-intuitive provision, the federal tax code (Code) treats FICA tax withholding differently depending on whether the compensation payments are made to the beneficiary/estate in the calendar year of the employee’s or former employee’s death, or in succeeding calendar years. Section 3121(a)(14) of the Code states that if compensation amounts are paid in the calendar year of the employee’s death or former employee’s death, such amounts will constitute FICA “wages” and therefore, are subject to FICA (Social Security and Medicare) tax withholding. However, Code Section 3121(a)(14) also confirms that these amounts will not constitute “wages” for FICA purposes, and therefore will not be subject to FICA tax withholding, if they are paid in the calendar year or years after the year in which the employee or former employee died.

Form W-2 or 1099?

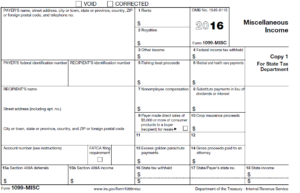

So what tax reporting forms must be issued to the beneficiary or estate to reflect the compensation payments made following an employee’s death? Under IRS Revenue Ruling 64-150, all amounts earned but unpaid at an employee’s or former employee’s death received by an estate or beneficiary of a deceased employee should be reported as non-employee compensation on a Form 1099-MISC. But, as explained below, the amounts reported on the Form 1099-MISC must take into account FICA tax withholding and therefore, will depend on whether the payments are made in the calendar year of the employee’s or former employee’s death or in the calendar year(s) after the death.

Specifically, for payments made in the same calendar year as the employee or former employee died, the payments are not subject to income tax withholding but are subject to FICA withholding. Therefore, employers should issue a Form W-2 for that year in the name of the employee or former employee (with the social security number of the employee), solely to reflect the FICA wages and the corresponding FICA tax withheld. The compensation/plan distributions should be reported in box 3, Social Security wages, and box 5, Medicare wages and tips, on the Form W-2. The corresponding employee Social Security tax withheld should be reported in box 4, and the corresponding employee Medicare tax withheld should be reported in box 6, on the same Form W-2. Finally, the net amount of the compensation/plan distributions made to the beneficiary/estate in that calendar year (“net” meaning the full amount of the payment less the amount of FICA taxes withheld) should be reported on a Form 1099-MISC, box 3, Other income, issued to the beneficiary/estate.

For payments made in the calendar year(s) following the year in which the employee or former employee died, no income tax or FICA taxes should be withheld and no Form W-2 is required. Instead, the full amount of the distribution payments should be reported on a Form 1099-MISC, box 3, Other income, issued to the beneficiary/estate.